In prior tax years, the charitable contribution deduction has only been available to taxpayers who itemize their deductions. To itemize your deductions, you have to have total deductions (e.g. real estate and sales/state tax, mortgage interest, medical expenses, charitable contributions) in excess of the standard deduction. Recent tax law changes have increased the standard deduction, resulting in fewer taxpayers claiming itemized deductions. This means that many people won’t see any additional tax benefit for their donations. This lead to decreased charitable giving.

In the midst of the pandemic, Congress sought to incentivize more charitable giving though a provision in the CARES act: for the 2020 tax year, taxpayers who take the standard deduction will be able to deduct up to $300 in cash charitable contributions as an “above-the-line” deduction. This means that, if you donate $300 during 2020, you can deduct your full standard deduction plus $300. Right now, for a single person, that means a combined deduction up to $12,700 ($12,400 standard deduction + $300 charitable contribution deduction). At present time, the IRS has not issued guidance on whether a married couple filing jointly will be entitled to a $300 or $600 deduction for 2020 charitable donations. So, a married couple filing a joint return could see a 2020 total deduction up to either $25,100 or $25,400 ($24,800 standard deduction + $300 or $600 charitable contribution deduction).

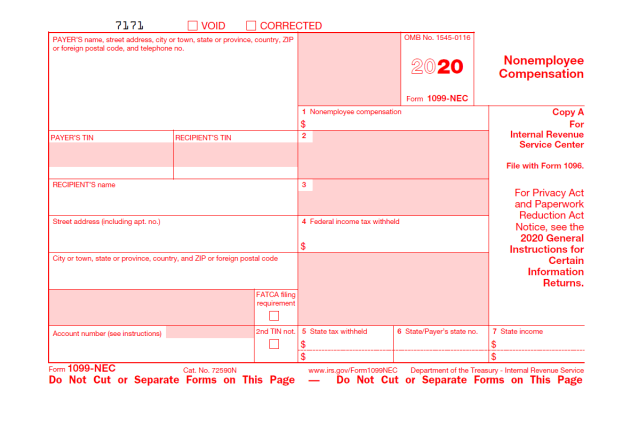

Of course, some restrictions apply. First of all, you must take the standard deduction to be eligible for this charitable donation “above-the-line” deduction. If you elect to itemize, all of your charitable contributions will be deducted “below-the-line” through Schedule A. Next, the donations must be made in cash. So, cleaning out your closet and taking huge bags of old clothes to Salvation Army will not garner you a deduction for this purpose.* You must make the donation via cash, check, or credit/debit card and follow the IRS’s documentation requirements for cash contributions.** Also, the contribution must be donated outright to a qualified charity; it cannot be a contribution to a donor-advised fund. Finally, the contribution must be completed during calendar year 2020. This deduction has not been made available for 2021.

You are probably wondering how much tax savings you can expect if you max out this new deduction. Well, if you are in the very top tax bracket of 37%, your tax savings on the $300 deduction will total $111. Most people will see a tax savings in the range of $30 – $72. Since it is an “above-the-line” deduction, it will lower your adjusted gross income (“AGI”), which could enhance your ability to claim certain other credits or deductions. If you live in a state with state income tax, the lower AGI could affect your state income tax liability.

So donate some dough to your favorite charity! If you don’t have a favorite charity, donate to a performing arts organization — many of them are hurting right now with the lockdown restrictions due to the pandemic. In any case, don’t miss out on this little gift from Congress!

FOOTNOTES:

* You can still deduct non-cash charitable contributions, but only as itemized deductions on Schedule A. If you elect to itemize your deductions, you are not eligible to take this additional “above-the-line” $300 charitable contribution deduction.

** See IRS Publication 526: Charitable Contributions, page 20, for substantiation requirements.

The fine print: This blog post is for educational and entertainment purposes only and is not intended as a substitute for tax advice. Please consult your tax advisor for guidance on your specific situation.