Mileage is a tricky one, especially since the IRS can’t seem to make up its mind about it. Here is a basic guide to what mileage is deductible (for Federal tax purposes…state income tax codes may vary) and a few other tweaks…

- Miles you drive to/from your home to/from your regular place of business are not deductible. These are “commuting” miles.

- Miles you drive to/from your home to/from your W-2 job or from W-2 job to W-2 job are not deductible. (Blame Paul Ryan.)

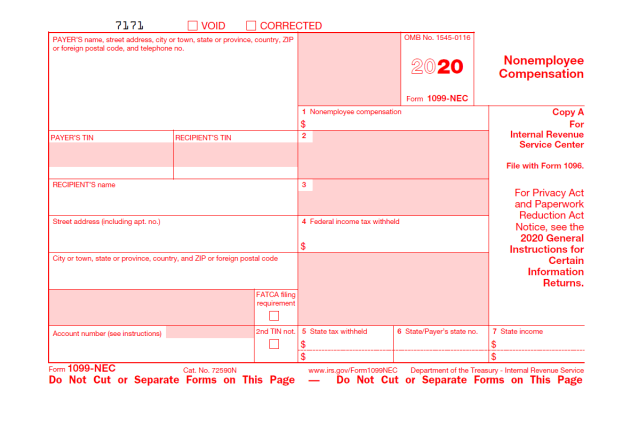

- Miles you drive from place of business to place of business* for freelance/1099 work ARE deductible. These are “business” miles. (*A “place of business” might be your home office.)

- Miles you drive to/from your home to drop off charitable contributions or provide charitable services are deductible (subject to itemized deduction rules).

- Miles you drive to/from medical care are deductible (subject to itemized deduction rules).

NEW FOR 2022: Business miles (see #3 above) are subject to two different standard mileage rates during 2022. Business miles driven January 1, 2022 through June 30, 2022 are 58.5 cents per mile; business miles driven July 1, 2022 through December 31, 2022 are 62.5 cents per mile.

Finally, the IRS has elevated mileage to one of the items they are examining more closely. If a return is selected for audit, the revenue agent will need to see documentation of the mileage deduction claimed. This can be from a mileage log, a mileage app, or some other reasonable method of mileage computation. “Same as last year” is not a reasonable method, so let’s make sure we are diligent with our recordkeeping. Personally, to track mileage, I keep a spreadsheet of business miles based on the appointments in my calendar. The spreadsheet has columns for date, origin, destination, purpose, round trip miles, tolls, and parking. I update it periodically.

And now I return to my regularly scheduled returns…

This information is for entertainment or educational purposes only. Please consult your tax advisor for advice on your specific tax situation.