You have probably heard by now that the IRS has extended the deadline to both file and pay your 2019 taxes until July 15, 2020. Read all about the Service’s COVID-19 relief plans here.

So, what does this mean?

This means that the calendar for payments and other deadline-related items has shifted a bit. The obvious change is the extra time to both file your 2019 tax return (Form 1040 et al) and pay the balance due without penalty on July 15th, 2020 (but see “The Fine Print” below). However, this affects a few other things I see in my practice:

1. Estimated tax payments for 2020

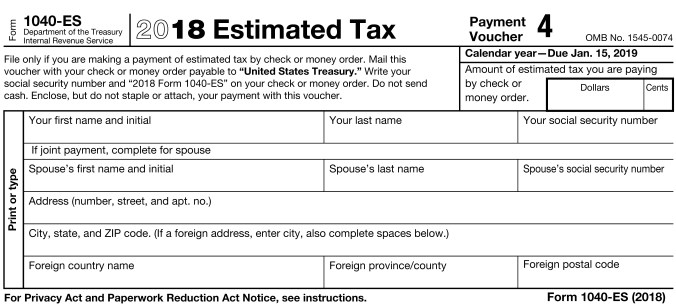

The timeline for making estimated tax payments (Form 1040-ES) for 2020 tax has shifted a bit…and it’s a little wonky. Here it is…

- 1st quarter 2020 is now due on July 15th, 2020

- 2nd quarter 2020 is still due on June 15th, 2020 (unchanged – please note that this is BEFORE 1st quarter is due)

- 3rd quarter 2020 is still due on September 15th, 2020 (unchanged)

- 4th quarter 2020 is still due on January 15, 2021 (unchanged)

So, if you pay quarterly, don’t miss that first payment for 2nd quarter, due June 15th, which is due before the payment for 1st quarter, due July 15th. Not confusing. Not at all.

2. IRA (Traditional or Roth) and HSA contributions for 2019 tax year

The deadline for these contributions has also been extended until July 15th, 2020.

3. SEP employer-portion contributions for 2019 tax year

The deadline for these contributions has also been extended until July 15th, 2020. However, this contribution deadline can be extended further until October 15th, 2020, by filing a valid extension for your tax return.

4. Tax return extension

You can request an additional 3 months time (until October 15th, 2020) to prepare and submit your completed 2019 tax return. The deadline to file this extension is now July 15th, 2020. However, if you anticipate a balance due, it must be paid no later than July 15th to avoid a possible penalty and interest.

So, what do I do?

Well, now would be an excellent time to gather your tax data and submit it to your tax preparer (or prepare your own return, if you’re into that). If you file quarterly estimated payments, you should try to get your return completed before the June 15th 2nd quarter payment due date. And, finally, refunds will still be issued within a few weeks of filing your return, so there’s no change there.

You could also send a little thank you note to the IRS Commissioner, Charles P. Rettig. I’m sure he would love to hear from you.