Nope, not confusing at all.

The IRS has done it again! They invented a new form! <Insert light applause here>

Never mind that they can’t get tax returns from March processed…they spent all those long days in quarantine coming up with…more paperwork! Was this the result of a failed IRS drinking game? Did somebody lose a bet? We will never know. What we do know is that the IRS came up with a separate form to replace one box on a very commonly used form because that won’t confuse anybody.

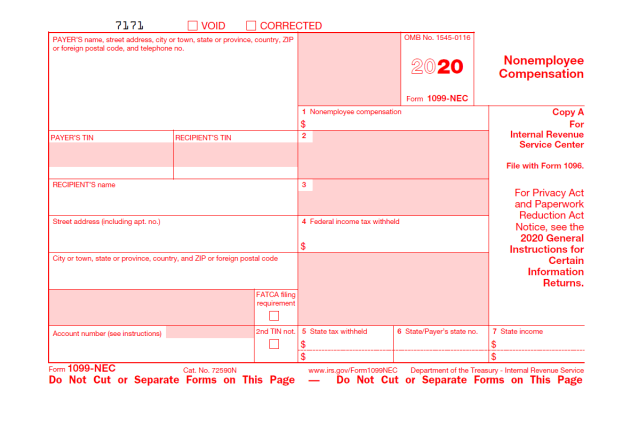

I give you <drumroll please> Form 1099-NEC! This form will replace Form 1099-MISC, Box 7 – Nonemployee Compensation. So, if you made (or think you will be making) payments totaling $600 or more to any independent contractor during calendar year 2020, you’ll need to prepare and file Forms 1099-NEC and 1096 by February 1, 2021. (The deadline to file these forms is usually January 31st, but in 2021 January 31st falls on a Sunday). Do not use Form 1099-MISC, Box 3 – Other Income to report these payments because that is not playing by the IRS’s rules and they really hate that.

To read more about this form, check out this article in Forbes magazine. It gives a pretty good description of the form and who needs to file it. The article was written by my new tax hero(ine), Kelly Phillips Erb, aka “TaxGirl”. Check out her blog here and her podcast here. For additional instructions, you can also consult the IRS’s website for information on Form 1099-NEC and Form 1096.

If you believe you will need to file Form 1099-NEC (or any other Form 1099 and Form 1096), you can order the forms *FOR FREE* from the IRS. Click here to place your order. Do it now because, in a plot twist that no one saw coming, it turns out that the IRS is a little behind on order fulfillment. Hard to believe, I know. The forms they will (eventually) send you are the tractor paper/carbon copy kind that would have probably been useful in like 1987. But they will work if you only have a few forms to fill out and don’t mind writing them by hand. If you need the kind that will go through your laser printer, you will have to purchase those elsewhere (online, Office Depot, etc).

Pro tip: spring for the 1099-specific envelopes at Office Depot. It makes your life easier and looks a whole lot more professional.

Stay tuned!

The fine print: This blog post is for educational and entertainment purposes only and is not intended as a substitute for tax advice. Please consult your tax advisor for guidance on your specific situation.